If your credit score is around 500, you may be wondering: Can I get a loan with a credit score of 500? The honest answer is: yes—but with caveats. A score of 500 is considered very poor in many credit scoring models, which means that traditional lenders will view you as high risk. Yet it’s not impossible to access lending options. What matters most is understanding how your score affects loan eligibility, what alternative routes exist, and how you can improve your credit over time.

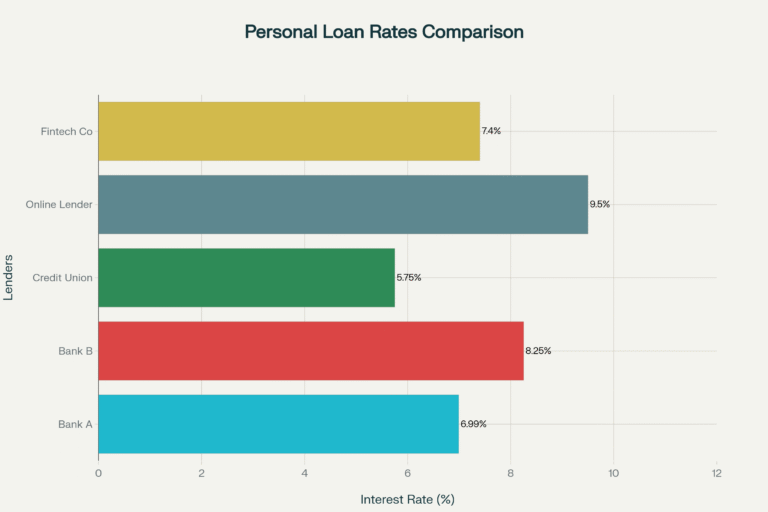

In the paragraphs that follow, you will gain insights into what a 500 credit score signifies, the types of loans you might qualify for, the factors lenders look at beyond credit scores, practical steps to apply, the hidden costs of bad-credit loans, and long-term strategies for rebuilding your credit. I’ll also link you to additional trusted resources like our another article on interest rates: Top 10 Things to Understand About Interest Rates and Personal Loan Rates Comparison 2025.

Understanding What a Credit Score of 500 Means

A credit score around 500 places you in the “Very Poor” range. According to Experian, a score between 300 and 579 is considered poor. What does this mean in practice?

-

It indicates you’ve had serious credit setbacks: late payments, defaults, high debt utilisation, or potentially bankruptcy or collections.

-

It suggests lenders believe your likelihood of default is higher than average.

-

It significantly reduces your access to standard loan products or favourable loan terms.

Consequently, when you apply for a personal loan, auto loan, or other credit product with a 500 score, you should expect:

-

Fewer lenders are willing to approve you.

-

Higher interest rates and fees to compensate for risk.

-

Smaller loan amounts and shorter repayment terms.

-

More stringent requirements (income, collateral, cosigner).

Nevertheless, having a 500 score does not mean you are permanently locked out of borrowing. It means you’ll need to approach things differently.

What Loan Options Are Available with a 500 Credit Score

When your credit score is low, certain types of loans become more realistic than others. These include:

Personal Loans for Bad Credit

Some lenders specialise in personal loans for borrowers with bad credit or low scores. According to Credible, borrowers with scores below 580 may still secure personal loans, but they are likely to face higher APRs and stricter conditions.

Secured Loans

In a secured loan, you pledge collateral (for example, savings, a vehicle, or other assets). The collateral reduces the lender’s risk, which improves your chances even with a low score.

Loans with a Cosigner or Co-Borrower

Using a cosigner with stronger credit can increase your likelihood of approval and improve terms. Some bad-credit lenders explicitly allow co-borrowers or cosigners.

Credit Union / Small Bank Alternatives

Certain credit unions or small community banks may have more flexible requirements and are sometimes more willing to consider non-traditional credit factors.

Caution: Payday Loans, Cash Advances

While you may find very quick loan options, they often come with very high interest rates, short terms, and the risk of a debt trap. Use these only as a last resort and with full awareness of cost.

Key Factors Lenders Consider Beyond Just the Score

A 500 credit score is a major hurdle, but lenders rarely look only at the score. They also weigh other factors, including:

-

Your income and employment stability: Are you earning enough, and do you have steady employment?

-

Your debt-to-income (DTI) ratio: How much of your income goes to repay existing debt?

-

Your credit history length and payment history: Have you made payments on time? How long have your accounts been open?

-

Collateral or cosigner presence: Are you offering extra security or a co-borrower?

-

Purpose of the loan and repayment plan: Do you show a realistic plan to repay the loan?

Because these factors matter, borrowers with a 500 credit score can improve their approval chances by strengthening these other areas—even if their score stays low.

Realistic Expectations: What You Should Expect When Borrowing

If you succeed in obtaining a loan with a credit score of 500, here are the realistic expectations:

-

Higher interest rates and fees: Some lenders report average APRs for bad-credit personal loans above 30 %.

-

Smaller loan amounts: You may only qualify for modest sums, unless you provide collateral or a cosigner.

-

Shorter repayment terms or stricter rules: Because the lender takes more risk, they might require quicker repayment or tighter conditions.

-

Strict repayment discipline is essential: Since you’ll likely face a higher cost of borrowing, missing payments will have even bigger negative consequences for your credit and finances.

-

Improvement opportunity: If you repay as agreed, you can rebuild credit, which improves future options.

How to Apply for a Loan with a 500 Credit Score: Step-by-Step

Here’s a pragmatic process you can follow:

-

Check and verify your credit report: Ensure there are no errors pulling your score down unnecessarily.

-

Calculate how much you need vs how much you can repay: Borrow only what you absolutely need and what you can repay comfortably.

-

Explore lenders specialising in bad-credit loans: Look for those that accept low scores, allow cosigners, offer secured loans, or are credit union-based.

-

Pre-qualify if available: Some lenders offer soft credit checks to see your potential terms without impacting your score.

-

Prepare documentation: Income proof, employment history, bank statements, etc. Having these ready strengthens your application.

-

Consider adding a cosigner or collateral: If you can, this improves your chance and possibly your terms.

-

Compare offers carefully—look beyond APR: Check origination fees, processing charges, pre-payment penalties, and repayment terms.

-

Apply and commit only if the terms are affordable: Avoid over-borrowing. Make sure monthly payments are manageable.

-

Repay on time, every time: This is vital. Timely repayment helps you rebuild credit and avoid worsening your score.

-

Work on rebuilding your credit score: While repaying, also take steps to improve your score for future borrowing.

Interplay with Interest Rates and Borrowing Cost

When your credit score is low, your interest rate or total cost of borrowing becomes especially critical. For further reading on how interest rates for loans work across credit profiles, see our article: Top 10 Things to Understand About Interest Rates.

Important points:

-

A higher interest rate means more of your payment goes to interest instead of principal, which slows down progress and increases total cost.

-

Borrowers with very poor credit may face significantly larger cost burdens, so ensuring you can repay is even more important.

-

You should calculate not just the monthly payment but the total cost of the loan over the term—including fees.

-

If your score improves even modestly, you may be able to refinance to better terms later.

Alternative Strategies If Standard Loans Are Hard to Get

If you find standard bad-credit personal loans too expensive or the terms too harsh, consider these alternatives:

-

Credit-builder loans: These are designed to help you rebuild credit rather than provide large sums of cash.

-

Secured or collateral-based borrowing: Offers an asset as security to reduce lender risk.

-

Borrowing from friends/family: If done responsibly and documented, this may be less expensive and less risky than high-fee loans.

-

Delay borrowing and focus on rebuilding credit: If you can wait, improving your credit score now may open far better options later.

-

Use community credit union programs: Some credit unions offer small emergency loans with better terms for members.

How to Rebuild Your Credit Score from 500

Improving your credit score is the most sustainable strategy. Key steps include:

-

Make all payments on time—payment history is the largest credit-score factor.

-

Keep your credit utilisation low (i.e., your debt compared to your credit limits).

-

Avoid opening many new accounts at once (which can appear risky).

-

Maintain older accounts to show a longer history.

-

Consider a secured credit card or small loan designed for rebuilding.

-

Review your credit report for errors and dispute any inaccuracies.

-

Monitor your credit score progress over time—seeing small gains can motivate continued improvement.

As you rebuild, you’ll gradually unlock better interest rates, larger loan amounts, and more favourable terms.

Risks and Things to Watch Out For When Borrowing with a 500 Credit Score

Because you are in a higher-risk category, be especially vigilant about:

-

Predatory lenders or debt traps: Extremely high APRs, hidden fees, short repayment periods, or roll-over terms can worsen your situation.

-

Over-borrowing: Because your borrowing cost is high, taking more than you can comfortably repay can lead to a downward spiral.

-

Damage to relationships if cosigner is involved: If you default, the cosigner’s credit and finances may suffer.

-

Impact on future credit opportunities: A missed payment or default may keep your credit score low for a long time, making future loans even harder.

-

False sense of relief: Just because you are approved doesn’t automatically mean the loan is a good idea. Approval is just one part—terms matter even more.

When It Might Be Better to Wait Rather Than Borrow Immediately

Sometimes the smartest decision is to delay borrowing. Consider waiting if:

-

You paid off some debts recently, and your credit is changing rapidly (you may qualify for better terms soon).

-

The loan you qualify for has a very high interest rate, and it would cost you significantly more than necessary.

-

You don’t need the money immediately, and you can improve your credit first.

-

You have a high-interest existing debt that you could address instead with a smaller alternative.

-

You risk taking on a loan you can’t comfortably repay within your income.

If you wait, use the time to rebuild credit and then access much better loan offers later—saving you money and stress.

Key Takeaways on “Can I Get a Loan with a Credit Score of 500”

-

Yes, borrowing with a 500 credit score is possible—but it comes with elevated cost and risk.

-

Your options may include bad-credit personal loans, secured loans, cosigner loans, credit-union emergency loans, or credit-builder loans.

-

Lenders will scrutinise income, debt-to-income ratio, employment history, and collateral/cosigner in addition to your score.

-

Expect higher interest rates, more fees, smaller loan amounts, and stricter repayment terms.

-

Focus on affordable repayment and rebuilding your credit—this will unlock much better loan options down the line.

-

Always compare offers carefully, read the fine print, and borrow only what you can repay.

FAQs

What credit score do I need to get a personal loan?

Many traditional lenders ask for a credit score of 600-650 or higher, but some specialised lenders will consider borrowers with scores in the 500 range if other factors (income, collateral, cosigner) are strong.

If my score is 500, how much could I borrow?

There is no fixed amount. With a score of 500, you may qualify for smaller loan sums unless you provide collateral, have a cosigner, or demonstrate low risk in other ways. Some lenders may cap loan amounts or impose stricter terms.

Will applying for a loan hurt my credit score further?

A “hard pull” from a lender can cause a small temporary drop in your credit score. However, many lenders allow pre-qualification via a “soft pull” that does not impact your score. It’s wise to compare several offers in a short timeframe so multiple hard inquiries are counted as one.

If I get approved with a credit score of 500, what interest rate might I pay?

Rates vary widely, but borrowers with very low scores often face APRs in the 30 %+ range, depending on the lender, loan amount, term, collateral, and other risk factors.

Is it possible to improve my credit score while I have a loan?

Yes—if you make all payments on time, keep debt levels manageable, and avoid new negative entries in your credit report, your score can gradually improve. A loan taken under manageable terms can even help rebuild credit.

Should I use a payday loan because my credit score is 500?

Generally, using a payday loan is very risky—these often carry extremely high interest and fees, short repayment periods, and can worsen your financial situation. Consider safer alternatives first.

Conclusion

In short, can you get a loan with a credit score of 500? Yes—but it will likely cost more, require extra effort, and demand strict repayment discipline. Rather than resigning yourself to high-risk borrowing, take the time to research lenders who work with bad credit, consider co-signers, loans with collateral, and always prioritise what you can realistically afford. At the same time, begin the journey of rebuilding your credit score so that in the future you can access better deals, with lower costs and more flexibility.

Remember: borrowing under difficult credit conditions is possible—but it should be approached carefully, with a clear plan. Use the links above to deepen your understanding: review how interest rates operate and compare current personal-loan rates to ensure you choose the best available offer. Borrow smartly, repay reliably, and build your credit towards better financial outcomes for tomorrow.