Opening an investment account is easier than ever, but selecting the right partner for your financial journey remains a crucial step. A brokerage firm is more than just a platform to buy and sell stocks; it’s the foundation upon which you’ll build your portfolio and work toward your long-term goals. So, how do you sift through the countless options to find the one that’s right for you?

This guide will walk you through the essential factors to consider, ensuring your chosen brokerage firm aligns with your investment style, financial objectives, and need for support.

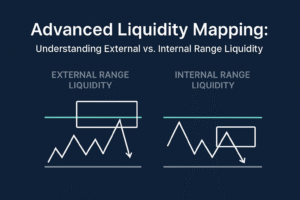

Understanding the Different Types of Brokerage Firms

Not all firms are created equal. Your first step is to understand the primary models in the market today.

-

Full-Service Brokerage Firms: These firms offer a wide array of services, including personalized financial advice, retirement planning, portfolio management, and access to a human financial advisor. They are ideal for investors who want a hands-off approach and comprehensive guidance, typically at a higher cost.

-

Discount Brokerage Firms: These platforms focus on providing a low-cost, self-directed trading experience. They offer the tools and resources for you to make your own investment decisions, with significantly lower fees and commissions. This model is perfect for the independent, DIY investor.

-

Robo-Advisors: A modern, automated type of brokerage firm that uses algorithms to build and manage a diversified portfolio for you based on your risk tolerance and goals. They are known for their low fees, ease of use, and hands-off management.

Key Factors to Evaluate Before You Choose

Once you’ve identified the type of firm that suits your style, drill down into these critical features.

1. Fees and Commissions: The Cost of Doing Business

This is often the most decisive factor. Be sure to scrutinize:

-

Trading Commissions: Are they charged for stock, ETF, or options trades? Many discount brokers now offer $0 commissions.

-

Account Fees: Look out for annual fees, inactivity fees, and account maintenance fees.

-

Expense Ratios: For mutual funds and ETFs, a high expense ratio can eat into your returns over time.

-

Additional Charges: Fees for wire transfers, paper statements, or broker-assisted trades can add up.

2. Investment Selection: What Can You Actually Buy?

A great brokerage firm should provide access to a wide range of investment products. Ensure the platform offers:

-

Stocks and ETFs

-

Mutual Funds

-

Bonds (Corporate, Government, Municipal)

-

Options and Futures

-

International Markets

-

Cryptocurrencies (if this is of interest)

3. The Trading Platform and User Experience

Is the platform intuitive and reliable? A clunky interface can lead to costly mistakes. Look for:

-

A clean, easy-to-navigate website and mobile app.

-

Stable performance, especially during periods of high market volatility.

-

Advanced charting tools, real-time data, and screening capabilities for active traders.

4. Research and Educational Resources

Whether you’re a novice or a seasoned pro, access to quality research is invaluable. A top-tier brokerage firm will provide:

-

Third-party research reports from firms like Morningstar or CFRA.

-

Educational articles, videos, and webinars.

-

Market analysis and commentary from in-house experts.

5. Customer Service and Support

When you have a question or encounter a problem, you need help fast. Evaluate the firm’s customer service by checking:

-

Availability: Are they available 24/7 via phone, chat, or email?

-

Responsiveness: How long does it take to get a helpful response?

-

Branch Access: Does a full-service brokerage firm have a local branch you can visit?

The Final Question: Full-Service Guidance or DIY Control?

Your choice ultimately boils down to your personal preference for involvement and support.

-

Choose a Full-Service Brokerage Firm if: You value personalized advice, want a comprehensive financial plan, and prefer to have a professional manage your investments. You are willing to pay higher fees for this white-glove service.

-

Choose a Discount Brokerage Firm or Robo-Advisor if: You are confident making your own decisions, are cost-conscious, and prefer a hands-on (or entirely hands-off, in the case of robo-advisors) approach to managing your money.

Conclusion: Your Partner in Building Wealth

Selecting a brokerage firm is a deeply personal decision that should not be taken lightly. It’s the partner that will facilitate your journey to financial growth. By carefully considering the types of firms, evaluating fees, tools, and resources, and honestly assessing your own investing personality, you can find a platform that doesn’t just execute trades but empowers you to achieve your financial dreams.