Are you searching for a credit card with a $2000 limit and guaranteed approval? If so, you’re not alone. Whether you’re building credit, rebuilding after a setback, or just want a little more spending flexibility, having access to the right credit card can make all the difference.

The good news? There are options that may be just what you’re looking for! In this post, we’ll break down everything you need to know about finding a credit card with a $2000 limit and what “guaranteed approval” really means.

Let’s dive in.

What Does “Guaranteed Approval” Really Mean?

You may be wondering… “Is it really possible to get approved for a credit card with a $2000 limit without any strings attached?”

Here’s the truth: while no lender can 100% guarantee approval for everyone, some credit cards offer extremely high approval odds – especially if you meet certain baseline requirements.

These cards are typically called “guaranteed approval” cards because they don’t require a traditional credit check, or they cater to people with less-than-perfect credit. Most of the time, you’ll just need to:

- Be at least 18 years old

- Have a valid Social Security Number or ITIN

- Provide a steady source of income

- Have a U.S. residential address

So while nothing is ever 100% “guaranteed,” there are credit cards that make the process a whole lot easier.

Why Would Someone Need a $2000 Credit Limit?

There are plenty of reasons why someone might want a higher starting limit. Maybe you want to cover emergency expenses, book travel, or simply have more breathing room in your budget.

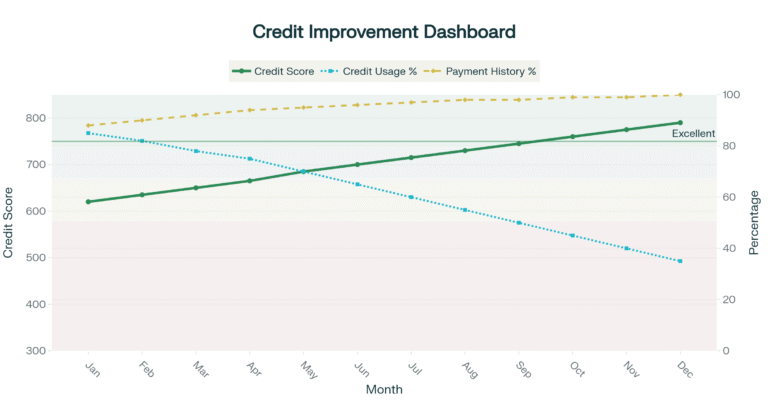

A $2000 limit can offer financial flexibility without being overwhelming. For many, it also helps improve your credit utilization ratio (that’s just a fancy way of saying how much of your available credit you use), which is an important factor in your credit score.

Think of it like this: if you only use $500 of your $2000 limit, that’s a 25% utilization rate — and generally, staying below 30% is great for your credit health.

Top Choices: Credit Cards with $2000 Limits and Easy Approval

Now, let’s get to the good stuff. Below are some credit cards that either offer a $2000 credit limit right away or make it easy to qualify for one in a short time.

1. Discover it® Secured Credit Card

Don’t let the word “secured” scare you off — this is one of the most popular cards for people who need to build or rebuild credit.

- Minimum deposit starts at $200, but people often qualify for higher limits quickly

- No annual fee

- Cashback rewards on everyday purchases

- Possibility of the $2000 limit with a higher security deposit

- Transitions to an unsecured card over time

If you can front a $2000 deposit (which becomes your credit line), you’ll be starting from exactly where you want to be.

2. Upgrade Visa® Card with Cash Rewards

This card is perfect if you want a mix of personal loan flexibility and a credit card.

- Up to $25,000 credit limit, depending on your credit profile

- No annual fee

- 1.5% cashback on payments

- Soft pull during pre-qualification (won’t affect your credit)

This is one of those cards where you may receive a $2000+ limit right from the start, depending on your income and credit history.

3. Reflex Mastercard® by Continental Finance

Designed for people with less-than-perfect credit, this card has high approval odds.

- Initial credit limits between $300 and $1000, with potential increases to $2000 over time

- Reports to all 3 major credit bureaus

- Available to applicants with poor or fair credit

- Annual fees may apply

If your credit isn’t the best, this could be your stepping stone to that $2000 goal.

4. Surge® Mastercard®

Similar to Reflex, this card is for those rebuilding credit.

- Credit limits start at $300 and go up to $2000 with responsible use

- Pre-qualification available

- Monthly reports to credit bureaus help improve your score

The trick here is consistent, on-time payments to unlock those higher limits.

5. Chime Credit Builder Secured Visa® Credit Card

This card is a game-changer for those new to credit.

- No credit check to apply

- No annual fees or interest charges

- Set your limit on how much you move into your secured account

So if you add $2000 to your secured account, guess what? That’s your limit.

Tips for Getting Approved With Higher Limits

Want to improve your chances of getting that $2000 limit (and keeping it)? Here are a few tips:

- Monitor your credit regularly so there are no surprises

- Pay down existing debt to free up credit and improve your utilization

- Apply only for cards tailored to your credit profile

- Use prequalification tools to check your approval odds without hurting your score

Remember: even if your initial limit isn’t $2000, many cards will review your account after a few months for potential increases — sometimes automatically.

Watch Out for Hidden Fees

One quick warning — not all credit cards are created equal. Some credit cards that promise easy approval also come with:

- High annual or monthly fees

- Hefty interest rates

- Hidden charges for things like paper statements or adding authorized users

So always read the fine print. If it feels too good to be true, it probably is.

Final Thoughts

Finding a credit card with a $2000 limit and easy approval isn’t just a dream — it’s achievable with the right approach. Whether you’re starting fresh or making a comeback, the key is choosing the card that fits your needs and financial goals.

Consider your credit profile, income, and how hands-on you’re willing to be with building your credit. With consistent on-time payments and smart spending, that $2000 credit limit could be just the start of a brighter financial journey.

Ready to take the leap? Make sure you explore your options, read the terms, and choose a card that supports your path to financial freedom.

What would you do with a $2000 credit card limit? Let us know in the comments!