In today’s fast-paced world, the dream of rapid wealth accumulation is enticing, leading many to search for “get-rich-quick schemes.” However, the reality is far from the alluring promises; these schemes often involve significant risks, financial loss, and rarely deliver sustainable success. This article delves into what these schemes truly are, why they attract so many, how to identify them, and most importantly, how to build genuine wealth through proven, ethical strategies.

What Are Get-Rich-Quick Schemes?

Get-rich-quick schemes are fraudulent or highly risky proposals that promise participants large financial gains with little effort, risk, or time investment. These schemes often target individuals eager to improve their financial situation quickly, leveraging psychological triggers like fear of missing out (FOMO) and the desire for instant gratification. While some may present themselves as investment opportunities, others are outright scams designed to separate people from their money.

Why Do People Fall for Get-Rich-Quick Schemes?

Humans are naturally drawn to shortcuts, especially when it comes to money. According to behavioral finance experts, cognitive biases—such as optimism bias and confirmation bias—can cloud judgment, making it easier to believe in unrealistic promises. Additionally, social proof, such as testimonials or celebrity endorsements, can make these schemes seem legitimate. The emotional appeal of overnight wealth often overrides rational decision-making, leading to significant financial losses.

Common Types of Get-Rich-Quick Schemes

There are several well-known types of get-rich-quick schemes:

-

Pyramid and Ponzi Schemes: These rely on recruiting new participants to pay earlier investors, collapsing when recruitment stalls.

-

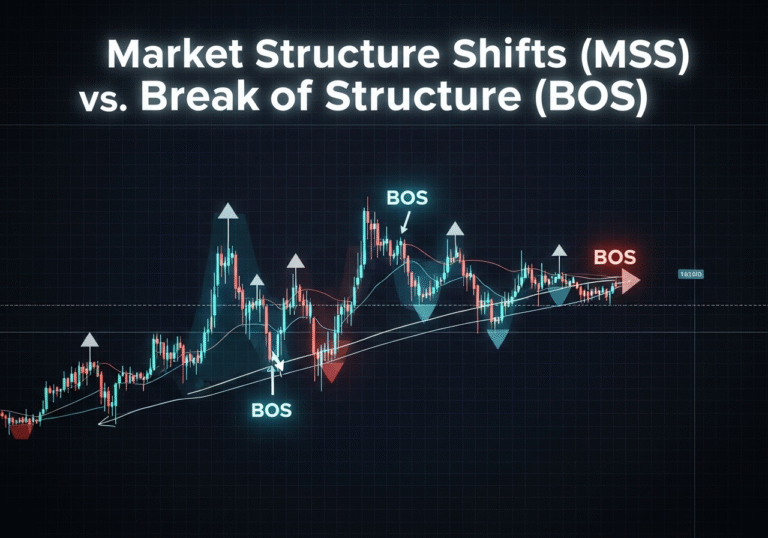

Cryptocurrency and Forex Scams: Promises of quick, high returns through trading “secret” strategies or insider information.

-

Online Surveys and Paid Tasks: Claims that you can earn thousands by completing simple online tasks, often requiring upfront payments.

-

Real Estate Flipping Gurus: Courses promising huge profits from flipping properties, often with misleading success rates.

-

Multi-Level Marketing (MLM): While some MLMs are legitimate, many operate on the edge of legality, focusing more on recruitment than product sales.

The Risks and Consequences of Get-Rich-Quick Schemes

The most obvious risk is financial loss. Many participants lose their savings, and in some cases, they may even incur debt. Beyond money, these schemes can damage credit scores, lead to legal trouble, and cause emotional distress. Victims often feel ashamed or embarrassed, which can prevent them from seeking help. The long-term consequences can be devastating, affecting not just financial health but also personal relationships.

How to Spot and Avoid Get-Rich-Quick Schemes

Here’s how you can protect yourself:

-

Research Thoroughly: Always check the legitimacy of any opportunity. Look for independent reviews and verify company registrations.

-

Be Wary of Guarantees: If it sounds too good to be true, it probably is. Legitimate investments never promise guaranteed returns.

-

Check for Pressure Tactics: High-pressure sales tactics and urgent deadlines are red flags.

-

Consult Professionals: Seek advice from certified financial advisors before committing money.

-

Educate Yourself: Learn about common scams and how they operate. Websites like the U.S. Securities and Exchange Commission (SEC) and Federal Trade Commission (FTC) offer valuable resources.

Building Real, Sustainable Wealth

Wealth building is a gradual process that requires discipline, education, and long-term planning. Some proven strategies include:

-

Investing in Index Funds: Diversified holdings in reputable index funds, such as those tracked by the S&P 500, offer steady growth over time.

-

Starting a Side Business: Monetizing skills and passions can provide additional income streams.

-

Budgeting and Saving: Tracking expenses and prioritizing savings helps build a financial cushion.

-

Continued Education: Staying informed about financial trends and strategies is crucial for long-term success.

Frequently Asked Questions

Are all get-rich-quick schemes illegal?

Not all are illegal, but most are either fraudulent or so risky that they might as well be. Always consult a legal or financial expert before participating.

Can you really get rich quickly?

While it’s possible to experience sudden windfalls through luck or high-risk ventures, these cases are extremely rare and not a reliable strategy for building wealth.

What should I do if I’ve been scammed?

Report the incident to local authorities, contact your bank, and seek legal advice. Resources like the FTC’s Complaint Assistant can help you take the next steps.