In the world of modern forex and stock market trading, moving beyond basic indicators has led many to methodologies that focus on market structure and the behavior of large, institutional players. Two of the most prominent and often-discussed approaches are the Inner Circle Trader (ICT) and Smart Money Concepts (SMC).

For newcomers and even experienced traders, the line between ICT and SMC can seem blurry. Are they the same? Are they rivals? This detailed analysis will cut through the noise, providing a clear comparison of their commonalities, core differences, and practical applications to help you decide which path aligns with your trading goals.

First, What Are We Talking About? Core Definitions

What is Smart Money Concepts (SMC)?

SMC is a framework, not a single strategy. It’s based on the premise that financial markets are driven by large institutions (the “Smart Money”) whose massive orders create imbalances in supply and demand. These imbalances leave footprints on the chart that retail traders can learn to identify.

The core goal of an SMC trader is to follow these footprints to trade in the same direction as the institutions, rather than being part of the “dumb money” that gets caught on the wrong side of the move.

Key Pillars of SMC:

-

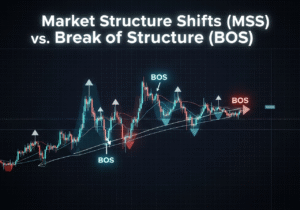

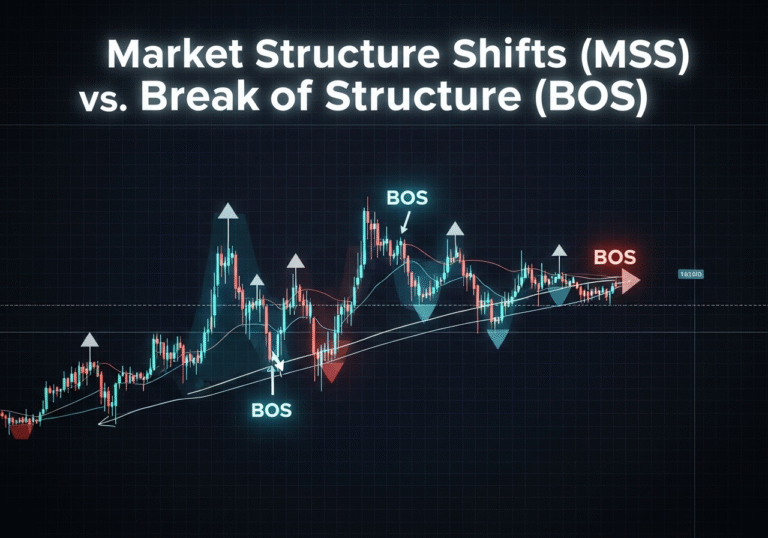

Market Structure (MSS): Identifying breaks and shifts in trends.

-

Order Blocks (OB): Areas where large institutional orders were previously placed.

-

Liquidity Pools: Price levels where a high volume of stop-loss orders are likely clustered, which institutions target.

-

Break of Structure (BOS) & Change of Character (CHOCH): Key signals for trend continuation and reversal.

What is the Inner Circle Trader (ICT)?

ICT is a comprehensive, proprietary trading methodology created by Michael Huddleston. While it is fundamentally built upon the principles of Smart Money Concepts, ICT expands them into a highly structured, multi-layered system with its own unique models and terminology.

ICT provides specific, time-based strategies for entering, managing, and exiting trades. It’s often described as a “mentorship in a methodology,” offering a complete curriculum for traders.

Key Pillars of ICT:

-

Market Maker Series (MMXM & MMXL): Models that predict potential market manipulation for liquidity.

-

Kill Zones: Specific times of the day (like the London Open, New York Open) when high-probability setups are most likely to occur.

-

Silver Bullet & Judas Swing: Specific candlestick patterns and price actions signaling imminent reversals.

-

Optimal Trade Entry (OTE): A refined Fibonacci-based retracement zone for entering trades.

-

ICT’s version of SMC concepts: He uses terms like FVG (Fair Value Gap) and Order Blocks but with his own specific rules for identification and trade execution.

The Common Ground: Where ICT and SMC Align

Before diving into their differences, it’s crucial to understand that both methodologies share the same philosophical foundation.

-

The “Smart Money” Narrative: Both acknowledge that markets are driven by large entities whose actions move price. The goal is to avoid being a “liquidity provider” for these players.

-

Price Action is King: Both methodologies are predominantly discretionary and rely on reading raw price action and volume (or volume proxies), rather than lagging indicators like MACD or RSI.

-

Focus on Market Structure: Understanding the “story” of the chart through swing highs, swing lows, and the sequence of these peaks and troughs is paramount in both ICT and SMC.

-

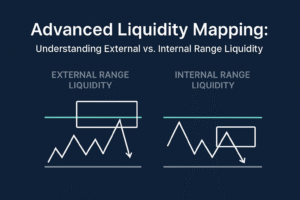

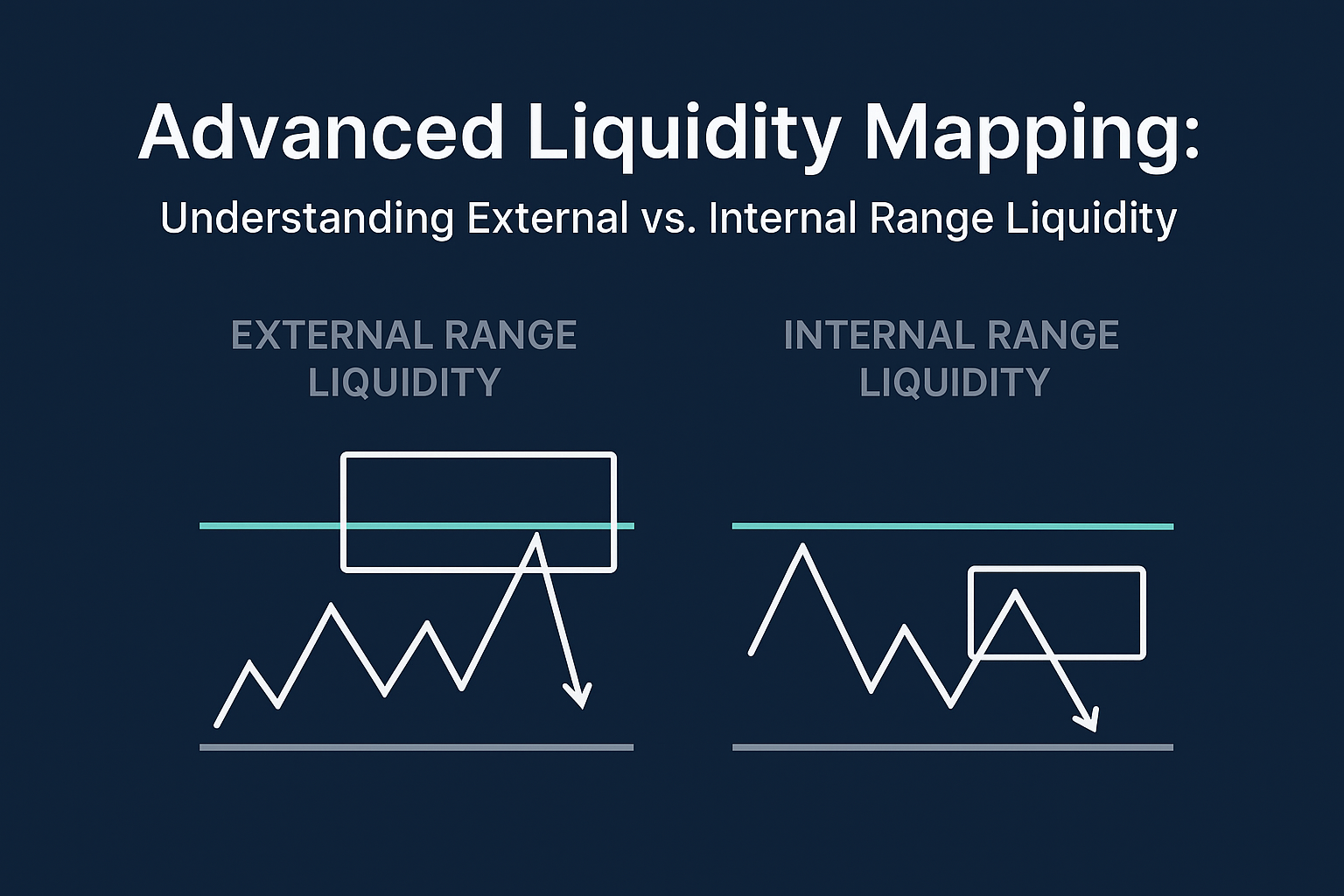

Liquidity as a Target: Both teach that price moves to areas of liquidity (previous highs/lows, equal highs/lows) to sweep stop-loss orders before reversing or continuing its true course.

-

Supply and Demand (Order Blocks): At their core, both use the concept of Order Blocks—consolidation areas where large orders were placed—as potential zones for future price reactions.

The Diverging Paths: Key Differences Between ICT and SMC

This is where the two approaches separate. Think of SMC as the fundamental theory and ICT as a specific, applied curriculum built on that theory.

| Feature | Smart Money Concepts (SMC) | Inner Circle Trader (ICT) |

|---|---|---|

| Nature & Structure | A framework of core principles. More flexible and open to interpretation. | A comprehensive methodology. Highly structured with specific rules and models. |

| Core Focus | Identifying the “footprints” of institutional order flow (e.g., BOS, CHOCH). | Executing specific, high-probability “setups” based on time and price. |

| Time Analysis | Generally not a primary focus. Setups can be valid on any timeframe, anytime. | Crucial. “Kill Zones” are central to the strategy, filtering for the most active market periods. |

| Terminology | Uses more universal terms (Order Block, Liquidity, MSS). | Uses proprietary acronyms & terms (OTE, FVG, Silver Bullet, Judas Swing, Kill Zone). |

| Entry Precision | Often relies on broader price action confirmation at a key level. | Highly precise, using the Optimal Trade Entry (OTE) for pinpointing entries within a zone. |

| Founder & Community | Decentralized; no single founder. A collective of concepts from various sources. | Centralized around Michael Huddleston; a vast, dedicated community learning his specific models. |

Deeper Dive into the Critical Differences

-

Flexibility vs. Specificity: SMC offers the building blocks, allowing a trader to build their own unique strategy. ICT provides a pre-built, detailed trading plan. This makes ICT easier to learn step-by-step but potentially less flexible than a pure SMC approach.

-

The Role of Time: The ICT emphasis on “Kill Zones” is a major differentiator. An SMC trader might see a perfect Order Block on a 1-hour chart at 2 AM and take it. An ICT trader would likely ignore it because it falls outside a designated Kill Zone, waiting for institutional participation to align.

-

The Learning Curve: SMC can feel fragmented and confusing initially because you’re piecing together concepts from different sources. ICT has a steep but structured learning curve, with a clear progression from basic to advanced concepts, all under one umbrella.

ICT vs. SMC: Which One Should You Choose?

There is no “better” methodology—only the one that is better suited for you.

Choose SMC if:

-

You are a more experienced trader who enjoys the freedom to build and customize your own trading system.

-

You prefer a conceptual framework over a rigid set of rules.

-

The idea of learning numerous proprietary acronyms and models is unappealing.

-

Your trading schedule is irregular, and you cannot trade only during specific “Kill Zones.”

Choose ICT if:

-

You are a beginner or intermediate trader who thrives with a structured, step-by-step learning path.

-

You want a complete, all-in-one system with clear entry, stop-loss, and take-profit rules.

-

You appreciate the predictive nature of specific models like the Market Maker Series.

-

You can discipline yourself to trade only during high-probability time windows.

Can You Combine Them?

Absolutely. Many successful traders do this. A common approach is to use the core SMC concepts (Market Structure Shift, Order Blocks, Liquidity) for the overall market bias and trade location, and then use ICT’s OTE and FVG concepts for refining the exact entry within that zone. This hybrid approach leverages the strengths of both.

Final Verdict

Smart Money Concepts is the “what” and “why” of institutional trading. It explains the underlying mechanics of why markets move.

The Inner Circle Trader methodology is the “how,” “when,” and “where” for a retail trader. It provides a practical system to act on those mechanics.

Your journey will likely start with one, but a deep understanding of both will make you a more well-rounded and proficient trader. Whichever path you choose, remember that consistency, discipline, and rigorous risk management are the true keys to long-term success.

Internal Linking & CTA Suggestions (To be placed at the end of the article or within the sidebar)

Ready to dive deeper?

-

New to these concepts? Start with our beginner’s guide: [What is Market Structure? A Foundational Guide for Traders].

-

Want to see it in action? Check out our video breakdown: [ICT Silver Bullet Strategy Live Trade Analysis].

-

Explore our other comparisons: [Price Action vs. Indicator-Based Trading: Which is Superior?].

(Disclaimer: Trading financial instruments involves risk. The information provided here is for educational purposes only and is not financial advice. Past performance is not indicative of future results.)