Welcome back to FinanceLiveHub! Your credit score is more than just a number — it’s a powerful tool that affects your ability to borrow, rent, or even get a job. If your credit score needs a boost, don’t worry. With some smart moves, you can improve it faster than you might think.

Why Does Your Credit Score Matter?

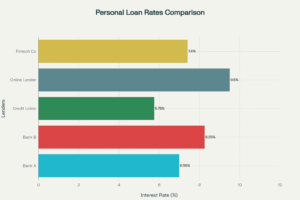

Your credit score is a snapshot of your creditworthiness. Lenders, landlords, and other institutions use it to decide if you’re a reliable borrower. A higher score means better loan rates, easier approvals, and more financial opportunities.

Quick Tips to Boost Your Credit Score Fast

1. Check Your Credit Reports for Errors

Start by pulling free credit reports from the major bureaus (Equifax, Experian, TransUnion). Look for mistakes—like incorrect accounts or balances—and dispute any inaccuracies immediately.

2. Pay Down Credit Card Balances

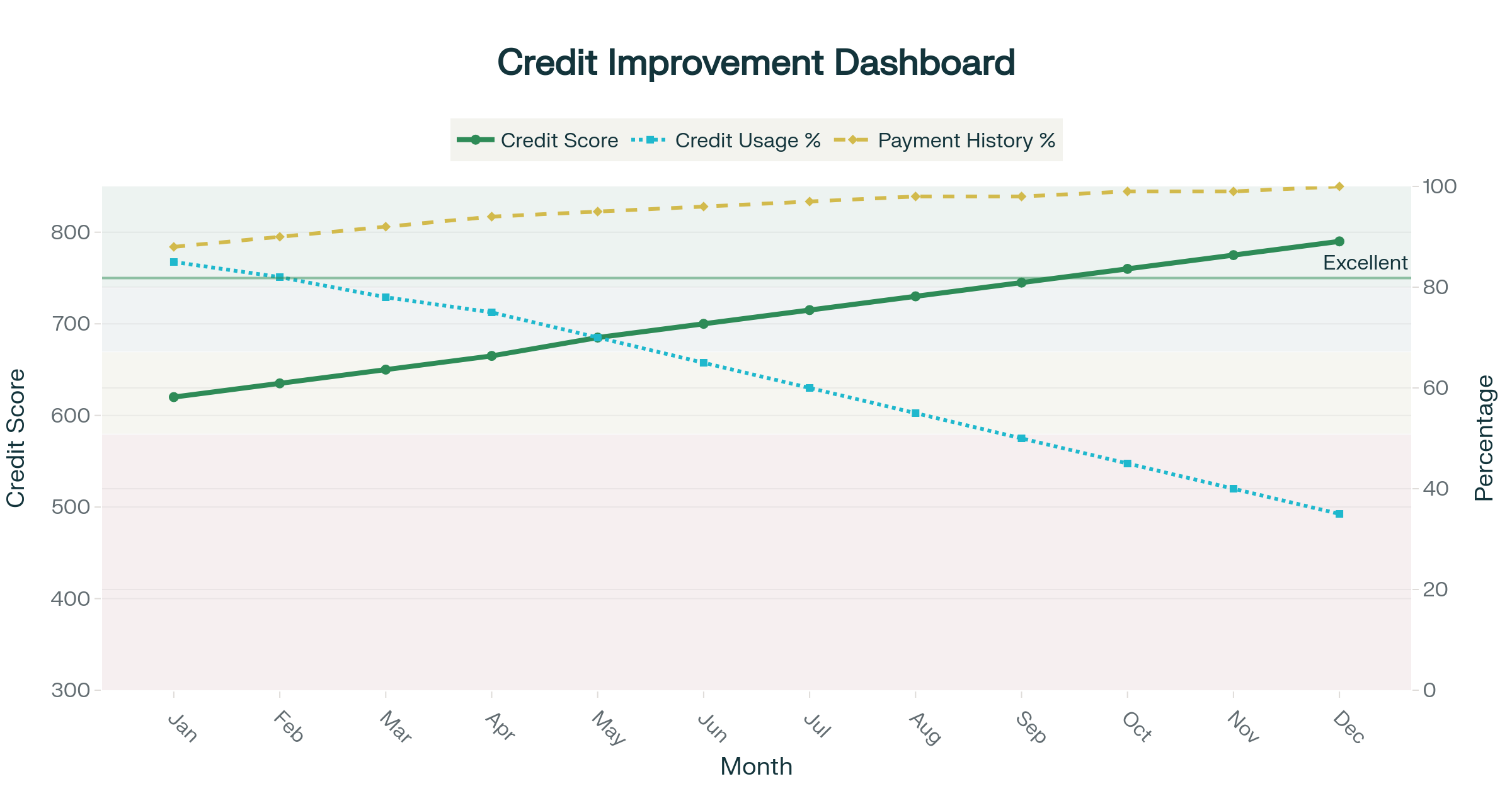

High credit utilization (how much credit you’re using compared to your limits) can drag your score down. Aim to keep utilization below 30%, or even better, below 10%. Paying down balances quickly signals you’re managing credit responsibly.

3. Become an Authorized User

If a family member or trusted friend has a solid credit history, being added as an authorized user on their account can give your score a boost with minimal effort.

4. Avoid Opening Many New Accounts at Once

Each credit inquiry can temporarily lower your score. Be strategic and space out new credit applications.

5. Set Up Automatic Payments

Paying bills late affects your credit. Automate payments for at least the minimum amount to avoid late fees and negative marks.

6. Negotiate or Remove Negative Items

Sometimes, creditors will agree to remove negative marks on your report if you explain your situation or negotiate a goodwill adjustment.

7. Use a Credit Builder Loan or Secured Credit Card

These tools help rebuild credit by demonstrating responsible borrowing and payment behavior.

How Long Does It Take to See Improvements?

While some changes, like disputing errors, can show quick results (within 30-45 days), others like paying down debt take a bit longer to reflect, generally 1-3 months. Consistency is key — healthy credit habits over time are what create lasting improvements.

FAQ: Fast Credit Score Improvement

Can I increase my credit score by 100 points quickly?

Significant jumps are rare overnight but achievable over a few months if you fix errors and lower high balances aggressively.

Does closing old credit cards help?

Usually, no. Closing accounts can shorten your credit history and increase utilization, potentially lowering your score.

Is it safe to use credit repair services?

Be cautious. Only use reputable companies, and remember, you can dispute errors yourself for free.

Final Thoughts from FinanceLiveHub

Improving your credit score fast isn’t magic — it’s about taking smart, consistent steps to show lenders you’re trustworthy. From fixing errors to paying down debts and building good habits, these strategies can bring your credit score back to life. Ready to get started? Take action today and open the door to more financial freedom.

Got questions or personal tips? Share your story with the FinanceLiveHub community in the comments below!