Borrowing smartly starts with knowing your options. Personal loans are one of the most accessible ways to get quick funds for emergency expenses, debt consolidation, or big purchases. But the cost varies widely depending on the lender and your profile. This 2025 guide from FinanceLiveHub helps you compare personal loan rates across major banks and NBFCs, so you can pick the best plan tailored to your needs.

What Are Personal Loan Interest Rates?

Personal loan interest rate is the cost you pay yearly on the borrowed amount. Lenders set it based on your credit score, income, employment type, and market conditions. Lower rates mean less overall cost.

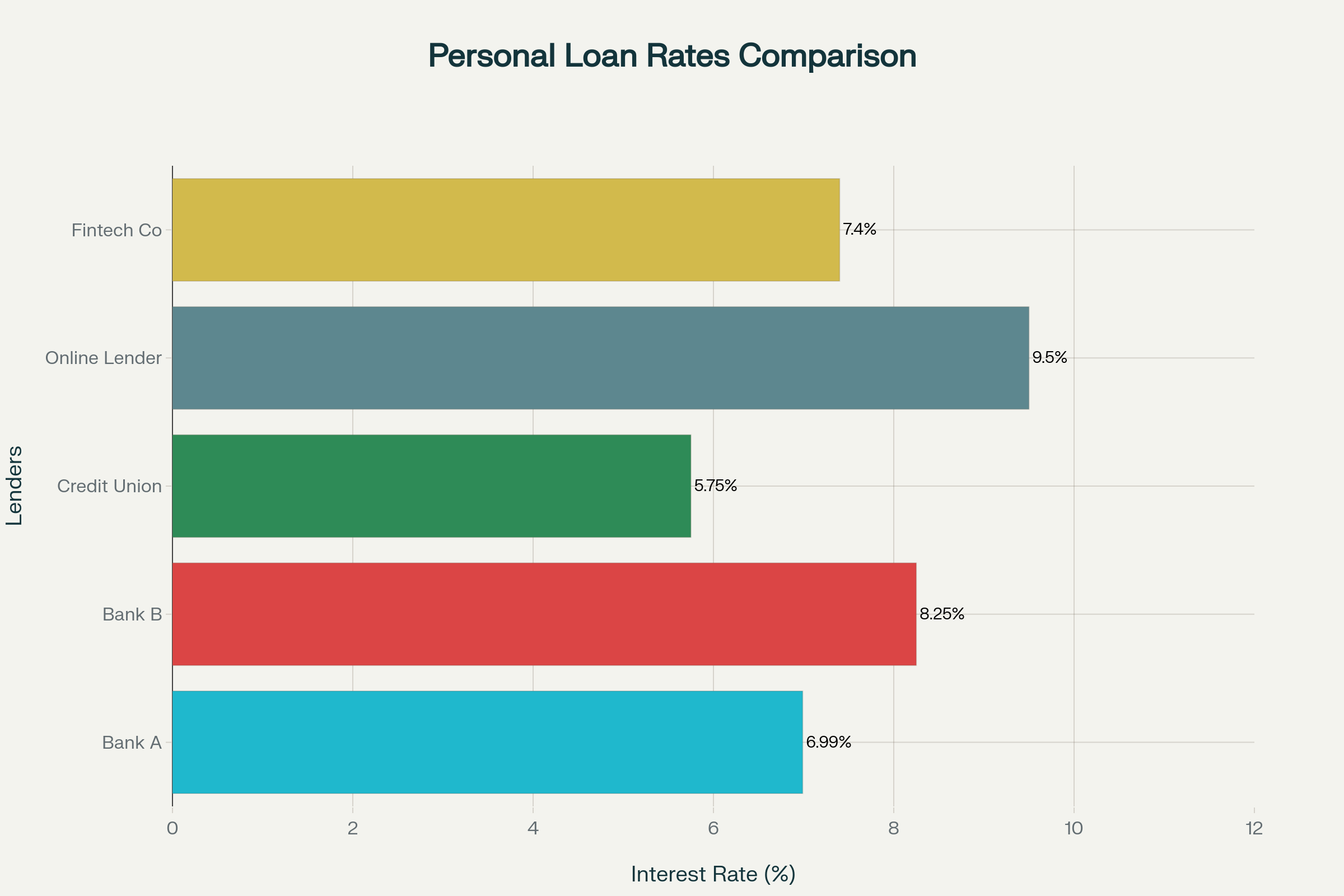

Current Personal Loan Rates Overview (2025)

| Lender | Interest Rate Range (p.a.) | Processing Fee | Loan Tenure | Special Offers |

|---|---|---|---|---|

| State Bank of India | 10.30% – 15.30% | 1% – 2% + GST | 1 to 7 years | Pre-approved for salary accounts |

| HDFC Bank | 10.75% – 24.00% | ₹4,999 + GST | 1 to 5 years | Quick disbursal, digital process |

| ICICI Bank | 10.60% – 16.50% | Up to 2% | 1 to 5 years | Lower rates for existing customers |

| Axis Bank | 9.99% – 17.15% | 1% – 1.5% | 1 to 5 years | Low processing fee, flexible EMI |

| Bank of Maharashtra | 9.75% – 14.55% | Up to 1.5% | Up to 5 years | Female borrower discounts |

Rates and fees are subject to change; always verify with the lender before applying.

Factors Affecting Your Personal Loan Rate

-

Credit Score: Higher scores get better rates; aim for 700+.

-

Income & Job Stability: Steady income from reputed companies lowers risk for lenders.

-

Loan Tenure: Shorter tenures usually have lower interest rates but higher EMIs.

-

Relationship with Bank: Existing customers often qualify for preferential rates.

-

Loan Amount: Large loans might have different slab rates.

How to Compare Personal Loan Offers

-

Don’t just look at interest rates—factor in processing fees, prepayment charges, and late payment penalties.

-

Use an online EMI calculator to estimate monthly payments.

-

Check if the bank offers pre-approved loans for faster processing.

-

Understand the documentation and eligibility requirements before applying.

-

Look for lenders with transparent policies and good customer reviews.

Tips to Get the Lowest Personal Loan Rate

-

Maintain a good credit score by timely payments and low credit utilization.

-

Keep your income proofs handy and ensure your employment records are clear.

-

Negotiate with your bank, especially if you have a history of good account behavior.

-

Opt for shorter tenures if affordable to reduce interest burden.

-

Consider loans from NBFCs and FinTech lenders for competitive rates but verify credibility.

FAQs on Personal Loan Rates

Q: Can personal loan rates change after approval?

Yes, if you have a floating interest rate loan, rates may vary with market changes.

Q: Are processing fees refundable?

Usually, no. Check lender’s terms to confirm.

Q: Do secured loans have lower interest rates?

Yes, secured loans backed by collateral tend to have lower interest rates than unsecured personal loans.

Q: How can I get pre-approved offers?

Maintain a good credit score and banking relationship; banks usually notify eligible customers.