Interest rates play a major role in personal finance, business decisions, and the overall economy. Whether you’re applying for a mortgage, saving for retirement, or running a business, interest rates determine the cost of borrowing and the return on savings. Understanding them isn’t just for economists—it’s essential for everyone.

This guide explores the top 10 things to understand about interest rates, providing clarity on how they work, why they change, and what they mean for your financial future.

What Are Interest Rates?

An interest rate is the percentage charged by a lender on borrowed money or earned on savings. In simple terms, it’s the cost of borrowing or the reward for saving.

For example, if you borrow $1,000 at a 5% annual interest rate, you’ll pay $50 in interest after one year.

👉 Learn more about interest rates on Wikipedia.

Why Interest Rates Matter

Interest rates matter because they directly impact:

-

Borrowers – Higher rates make loans more expensive.

-

Savers – Higher rates mean better returns on savings accounts.

-

Investors – Rates influence stock market trends and investment choices.

-

The Economy – Rates affect inflation, employment, and consumer spending.

When interest rates rise, borrowing slows down, but savings grow. When rates fall, borrowing increases, but saving becomes less attractive.

Types of Interest Rates

Fixed Interest Rates

A fixed rate doesn’t change over the loan’s life. For example, a 30-year fixed mortgage keeps the same rate from start to finish.

Variable Interest Rates

Variable rates change over time and are often linked to market benchmarks like the prime rate or LIBOR.

Compound Interest

Called the “eighth wonder of the world” by Albert Einstein, compound interest grows savings faster by earning interest on both the initial amount and previously earned interest.

Simple Interest

Simple interest is calculated only on the original amount borrowed or saved, not on accumulated interest.

How the Federal Reserve Influences Interest Rates

The Federal Reserve (Fed) sets the federal funds rate, which is the rate banks charge each other for overnight loans. This decision impacts all other interest rates, including mortgages, car loans, and credit cards.

When inflation rises, the Fed often raises interest rates to slow down spending. When the economy struggles, it lowers rates to encourage borrowing and investment.

The Role of Inflation in Interest Rates

Inflation and interest rates are closely linked. High inflation usually leads to higher interest rates, while low inflation supports lower rates.

For example, if inflation is at 3%, and the interest rate on savings is 2%, savers are actually losing money in real terms.

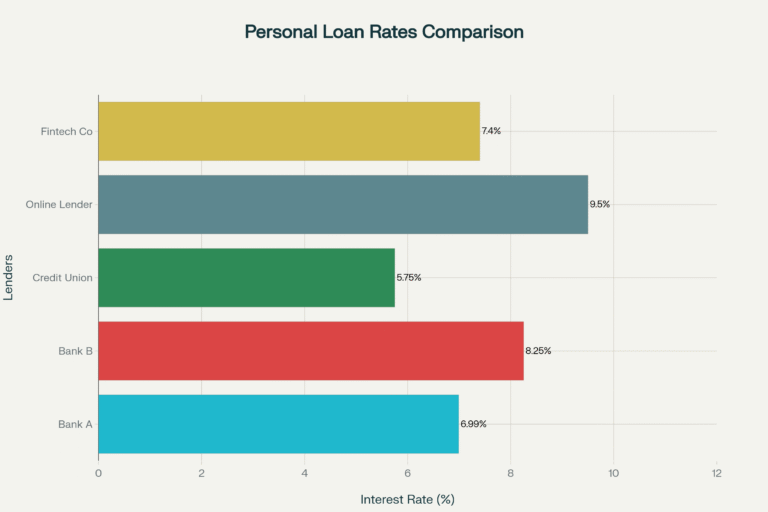

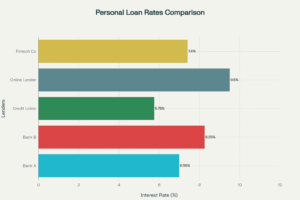

How Interest Rates Affect Borrowing

Borrowing money becomes more expensive when rates are high. This affects:

-

Personal loans

-

Credit card balances

-

Car loans

-

Student loans

A small change in rates can significantly impact monthly payments and long-term costs.

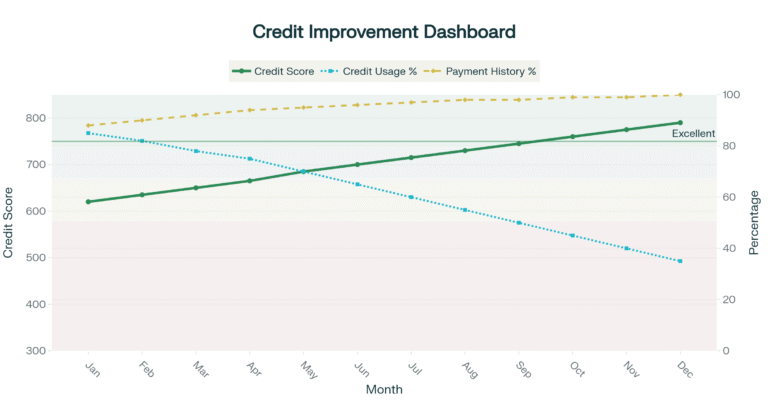

Impact of Interest Rates on Savings

On the flip side, higher interest rates benefit savers. Savings accounts, certificates of deposit (CDs), and Treasury bonds become more attractive.

This encourages people to save more, which can slow down consumer spending but strengthens long-term financial security.

Mortgage Rates and Homeownership

One of the biggest areas impacted by interest rates is mortgage loans.

-

Lower rates make buying homes more affordable, boosting demand.

-

Higher rates increase monthly payments, making homeownership harder.

A small rise in rates can cost homeowners thousands of extra dollars over the life of a loan.

Interest Rates and the Stock Market

Interest rates affect the stock market in several ways:

-

Rising rates make borrowing costlier for businesses, reducing profits.

-

Falling rates encourage investment and stock growth.

This is why Wall Street closely monitors the Fed’s interest rate decisions.

Global Impact of US Interest Rates

Since the US dollar is the world’s reserve currency, changes in US interest rates ripple across global markets. Higher US rates often strengthen the dollar but can create challenges for developing economies.

How to Track Interest Rate Changes

To stay informed, monitor:

-

The Federal Reserve’s announcements

-

Financial news outlets like CNBC and Bloomberg

Being aware of rate changes can help you make smarter borrowing and saving decisions.

Smart Strategies for Managing Loans and Debt

-

Refinance loans when rates are low.

-

Pay extra toward high-interest debt.

-

Consolidate loans to secure lower rates.

-

Build an emergency fund to avoid high-interest borrowing.

Common Misconceptions About Interest Rates

-

Myth: Interest rates always move in one direction.

-

Fact: They fluctuate based on economic conditions.

-

Myth: Low interest rates are always good.

-

Fact: They can lead to inflation and reduce savings returns.

FAQs About Interest Rates

Q1: What is the difference between APR and interest rate?

APR includes fees and costs, while the interest rate is just the borrowing cost.

Q2: How often does the Federal Reserve change rates?

The Fed typically reviews rates eight times per year, but can adjust in emergencies.

Q3: Do high interest rates always mean high inflation?

Not necessarily—rates are just one tool used to control inflation.

Q4: How do interest rates affect credit cards?

Higher rates mean larger balances and more expensive debt if not paid off monthly.

Q5: Should I refinance my mortgage if rates drop?

Yes, refinancing can save thousands if you plan to stay in the home long-term.

Q6: What’s the historical average interest rate in the US?

Historically, US rates average around 5–6%, though they’ve been much lower in recent years.

Conclusion

Understanding the top 10 things to understand about interest rates is essential for making smart financial decisions. From loans and mortgages to savings and investments, interest rates affect nearly every aspect of money management.

By staying informed, tracking the Federal Reserve’s policies, and applying smart strategies, you can minimize borrowing costs, maximize savings, and build long-term wealth.